Is cash management costing your business the time and money? Keep the expensive options for last and choose what brings more productivity and ROI. That said, cash flow management services from Flatworld Solutions (FWS) is what most corporates consider to optimize their revenue. It reduces the accounting errors and dependence on more resources.

If you don't want your team to spend hours struggling with account reconciliation, payable processing, budgeting, cash flow forecasting, fraud management, and contract review then outsource roles to a cash management service provider like FWS. With 20 years of experience in company cash management, we have worked with companies of all sizes to help them improve the revenue. We take care of your financial errands so you spend more time making decisions.

Cash Flow Forecasting Services We Offer

Ineffective financial management can make or break revenue bottom lines and can severely dent growth prospects. A viable proposition alternative is to outsource cash management to a professional service provider. Such partnership frees you from the burden of managing routine cash management tasks and puts the focus back on acquiring new customers and solidifying stakeholder relationships. Our cash flow / money management services include the following -

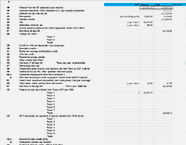

Daily Cash Flow Report Maintenance (Sales, Deposits, Expenses)

We help you keep track of your daily cash flow without accounting errors. We perform comprehensive accounting and data compiling to produce custom reports for sales, expenditure, and other transactions. The daily cash flow reports help in tracking financial performance on a weekly basis to adjust short-term goals.

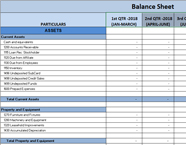

Accounts Payables and Receivables

Keeping track of account payables and receivables can be challenging in a large and complex business environment. Therefore, we enhance the agility and accountability of your financial transactions by keeping track of the fund movements. In this way, we will flag any dues that are causing a bottleneck in your revenue streams.

Credit Card Report Reconciliation

We will match every transaction that has occurred within a financial term by matching the credit card statement with your internal records. If there is a mismatch we will flag the data warranting further action from your accounting department. We will create comprehensive reports for every credit card transaction to optimize the accountability of credit management.

Financial Risk Management

Not sure whether you are walking the financial tightrope? Leave the guesswork behind and take control of your financial performance by referencing the risk statements. We will analyze your financial process and the system to assess if there are vulnerabilities that can increase the financial risks. By making accurate assessment we will help you safely manage the finances.

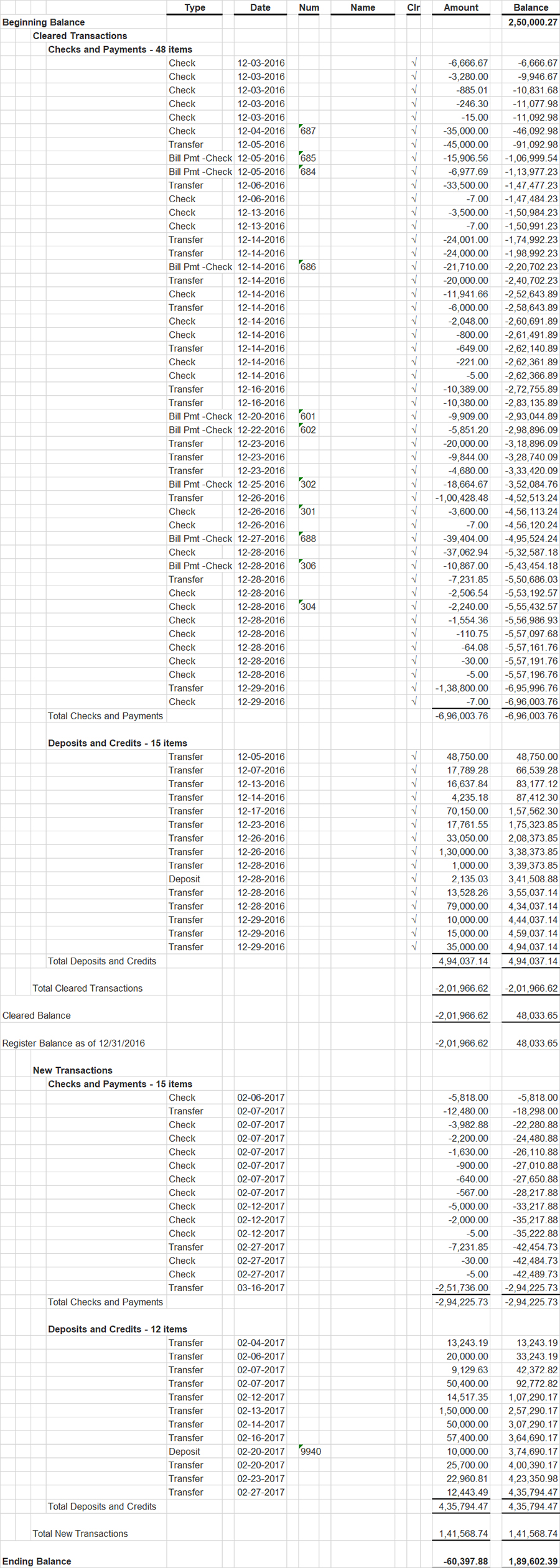

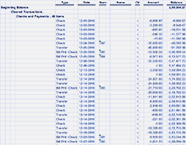

Bank Statements Reconciliation

We ensure the accuracy of your company's cash flow by comparing and matching the account balance on your company's balance sheet. We will carry out the process with due diligence to help you plan and implement financial models. Our bank statement reconciliation is the final step to make sure that your company's financial records are immaculate.

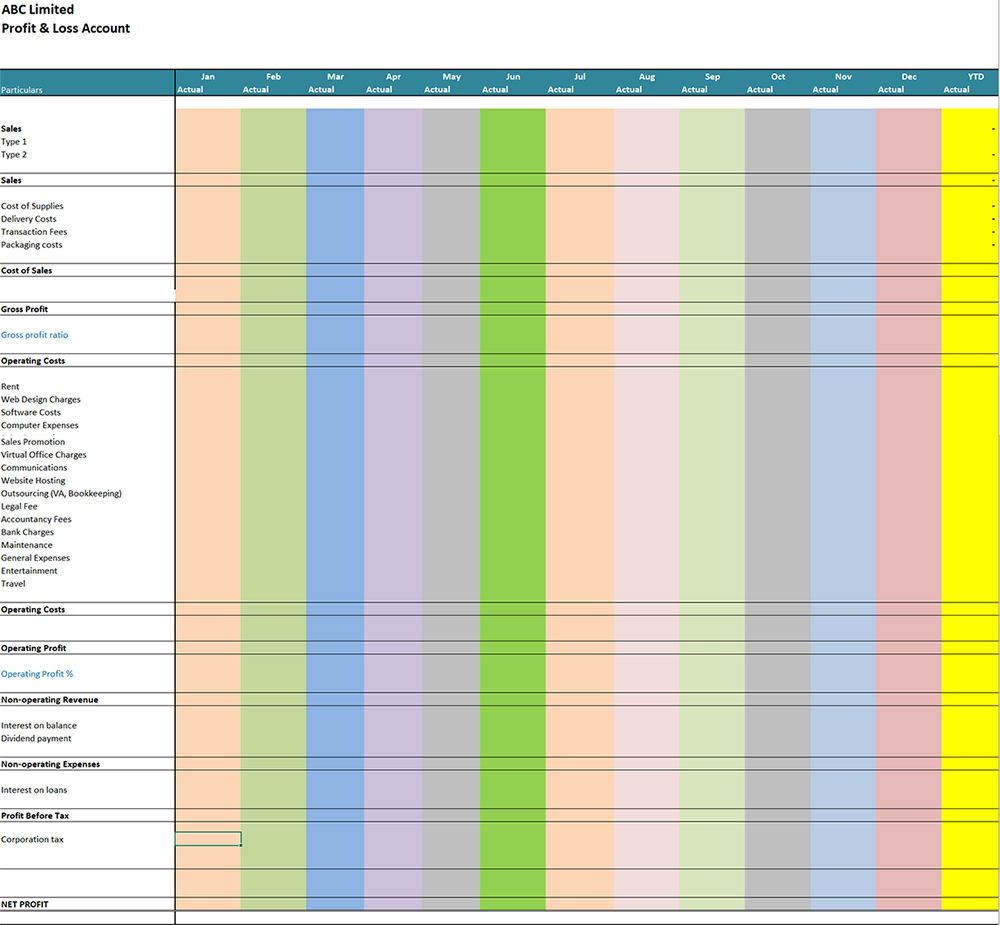

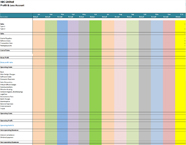

Cash Flow Budgeting

Cash flow budgeting is a complex process where the accuracy of the financial records is paramount in making correct estimations. We verify cash receipts and expenditure between time periods to apply the approximation method. Our findings will help you estimate the budget needed for the following term.

Cash Flow Forecasting And Planning

Cash flow forecasting is the solution you need to get answers about the financial prospects of your business. We will analyze your financial inflow and outflow to provide an estimation of your business's financial position in a specific timeframe. Our forecasts are 97% accurate because we use highly advanced business algorithms to compute the projections so that you can plan your goals with precision.

Fraud Management

If you need a robust fraud management solution, your search ends with us. We thoroughly monitor transactions taking place within your business. Be it channels, users, or accounts we leave no stone unturned. The data will be captured and screened by combined efforts of AI-based fraud management systems and risk management analyst.

Managing Electronic Payments

If managing and reviewing payments by traditional methods are becoming cumbersome we can electronically manage it on your behalf so that you get nothing short of a reliable and accurate payment record. We use scalable system that supports multi currencies and integrates with bank accounts for streamlined functioning for your financial system.

Reviewing Financial Contracts

We minimize your financial exposure by reviewing areas of the contract with due diligence. Our team of legal experts will scrutinize the contract especially the sections pertaining to financial and legal liabilities. With our contract review support you can be sure to avoid risks to your assets.

Our Finance and Accounting Portfolio

Accounting

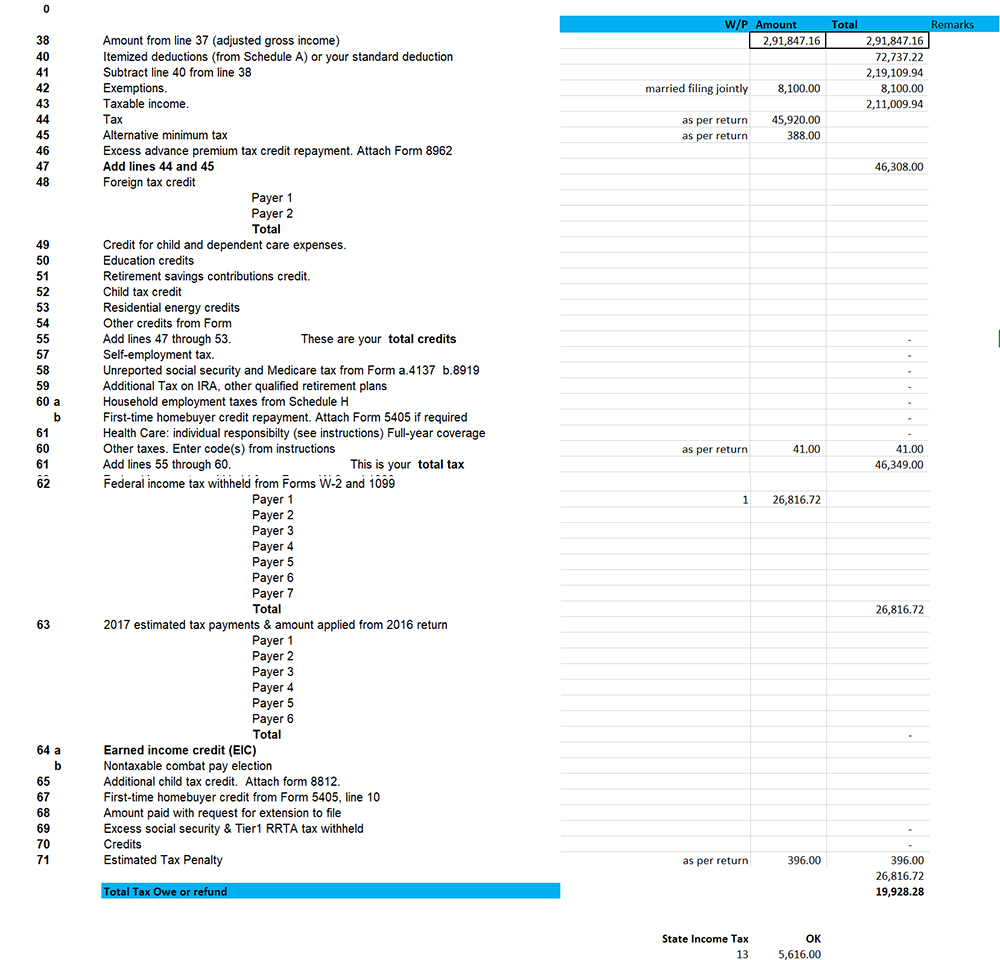

Tax

Bookkeeping

AR

Cash Flow Management Process We Follow

Requriement Discovery

As with any outsourcing relationship that we are involved with, we begin proceedings by first understanding your business in detail

Requirement Analysis

We delve into understanding your current finances. We study various other components such as accounts payables / receivables, cash flow statements, credit terms, inventory management, etc.

Cash Management Strategy

After undertaking this analysis, we prepare a cash flow statement that will give you insights such as future funding requirements and investment opportunities

Cash Management Services

Our team will execute the requested service as per the plan while simultaneously generating comprehensive reports for you to evaluate the process

Reporting

We will create individualized reports in each project and send the same as an encrypted file for perusal

Why Outsource Cash Flow Management Services to Flatworld Solutions?

For more than a decade, Flatworld Solutions has worked with global companies helping them with their cash management outsourcing needs. Whether it is managing daily cash flow activities or long term cash flow planning we can take on projects of varying complexities. Backed by a team of financial accountants, analysts and project managers, we take care of your cash flow transitions, without any hassles. Here are more reasons why it makes sense to be supported by a cash management service providing company like us -

ISO Certifed Company Managing Cash Flow Management System

Flatworld Solutions is an ISO 9001:2015 certified company that emphasizes on the quality of services to bring its client a step closer to realizing their goals.

100% Data Security

Confidential business data is always safe with us. Our project team consists of professionals who have signed the non-disclosure agreement. This gives our clients the peace of mind knowing that their financial data is always safe with us.

Affordable Cash Flow Management Services

Managing corporate cash flows has always been a solution that is easily affordable to all our clients. This is because we give our clients the option to choose the service they need. Therefore, helping them save hundreds of dollars from each project.

High-quality Cash Flow Management Services

Our services are fully monitored and scrutinized by a team leader to ensure that the workflow is compliant with the quality expectations of the client.

Quick Turnaround Time

On-time project delivery within budget is our signature trait. We can expedite the project if our clients have a tight deadline.

Scalable Services

Our professionals follow the best practices to ensure that our clients are 100% satisfied. FWS's cash flow management services can be scaled up or down with ease. This gives our clients the flexibility to get opt more resources if they can't realize their goals with limited resources.

SPOC

A SPOC will be assigned to be in touch with every client we work with. This will help in closing the gap in communications. Concerns or queries from the clients reach us quickly though the SPOC.

FTE Cash Flow Management Experts

Our core team consists of accounting professionals, financial analysts, process management consultants, and chartered accountants. With highly-qualified professionals behind every cash flow management process our clients always feel confident about us managing their cash flow system.

Superb Infrastructure

We have the best infrastructure that enables our team to leverage AI, ML, and a host of other technologies to handle complications in the project.

Round-the-clock Support

We offer continuous support to our clients so that their concerns can be resolved in no time. We have 24/7 multi-lingual contact centers around the globe to support clients from all time zones.

Other Services You Can Benefit From

Outsource Cash Flow Management Services to Flatworld Solutions

More than a decade of experience in outsourcing has helped Flatworld Solutions work with customers of all sizes and from different industry verticals. This has allowed us to work on banking, manufacturing, healthcare, IT, Media and Government projects. Our ability to accurately understand different businesses, and handle various projects effectively at the same time has set us apart from our competitors.

Read our article which lists some of the latest trends in cash flow management for the coming year and beyond.

Get in touch with us if you prefer to outsource cash flow management services and we help you get started.

Our Customers

Philippines Finance and Accounting Services

Hire experienced and talented Filipino finance & accounting professionals & for your business

USA

Flatworld Solutions

116 Village Blvd, Suite 200, Princeton, NJ 08540

PHILIPPINES

Aeon Towers, J.P. Laurel Avenue, Bajada, Davao 8000

KSS Building, Buhangin Road Cor Olive Street, Davao City 8000