Is accounting fraud making you worry and shifting your focus from the core operations of your business? Are you worried about the propriety of your accounting and financial reporting, regulatory scrutiny, anti-corruption inquiries, and accounting fraud? Are you looking for ways to safeguard your assets and reputation and resolve issues with minimum disruption to your business and prevent recurrences from happening? If so, you are in the right place.

Flatworld Solutions is a leading provider of forensic accounting services and has helped numerous clients from all over the world with their forensic accounting needs. Some research suggests that four out of every five companies with employee strength is adversely affected by embezzlement. This is where the need for forensic accountants arises. The team at Flatworld Solutions can investigate the suspicious areas and collect appropriate evidence to separate confusion and suspicion from the real facts.

Forensic Accounting Services We Offer

Flatworld Solutions is one of the top forensic accounting companies and provides a complete range of forensic accounting solutions. We offer the services of highly-experienced investigating and forensic accounting experts who have a sharp eye for detail when it comes to investigating and analyzing specific accounting situations.

We offer accounting fraud detection services and forensic accounting services in the following areas

Investigations Related to Regulatory Compliance

1. Frauds did by financial institutions

2. Frauds carried out in the healthcare and other domains

3. Investigations of concerns raised by whistleblowers

4. Investigations related to SEC, USA PATRIOT Act, DOJ, USA PATRIOT Act, etc.

5. Defense of white collars

Investigations Related to Bankruptcy

1. Areas related to bankruptcy fraud

2. Conveyance actions that are fraudulent

3. Payments that are preferential

Investigations Related to Expert Testimony and Litigation Support

1. Instances of breach of fiduciary duty

2. Areas of director and officer liability

3. Disputes about insurance coverage/interruptions in business

4. Areas of securities and litigation of shareholders

5. Areas related to purchasing price disputes post-acquisition, working capital, billing and earn-out

Additional Investigation Services

1. Due diligence and investigating background

2. Computer forensics and data mining

3. Management fees and transactions of related parties

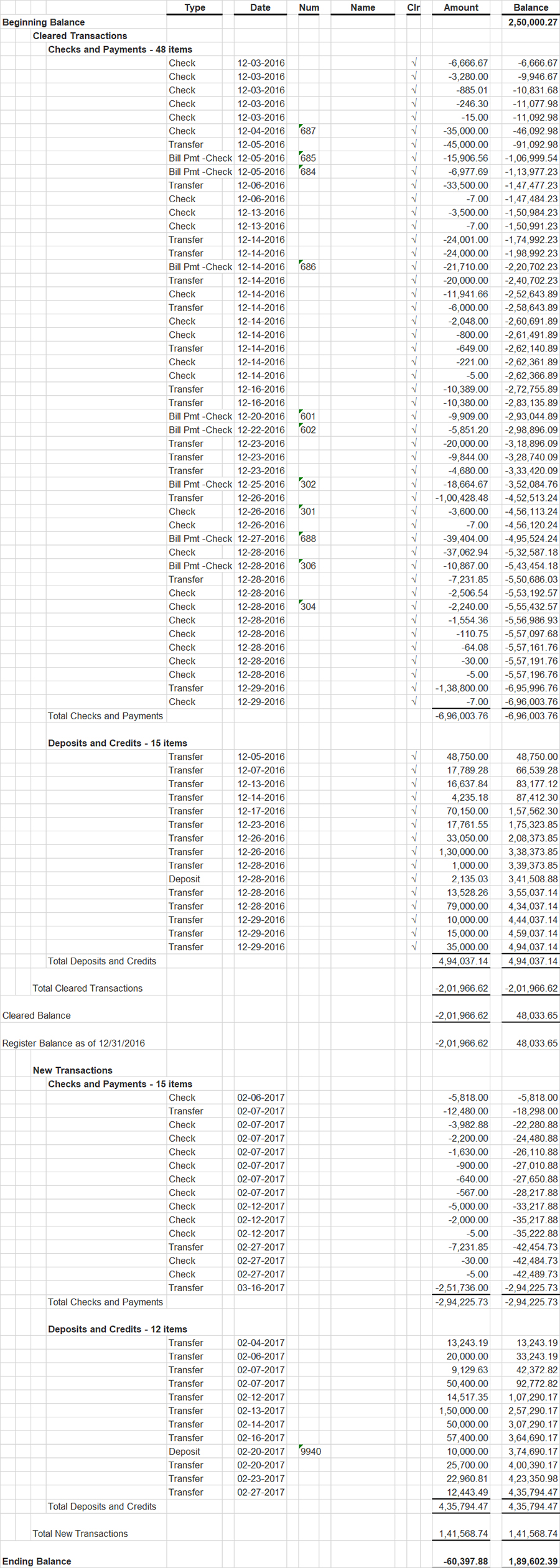

4. Tracing misappropriated assets, and financial embezzlement

5. Cases of misrepresentation of financial statements, and any other financial fraud

6. Claims of fidelity

7. Claims of fidelity

Types of Fraud Investigations We Handle

We are a leading provider of fraud investigation services and understand that it can be difficult to easily detect fraud or fraudulent activities. There are multiple interpretations and meanings of the word "fraud" and it relates to several different types of investigations and allegations. They include

Employee Fraud: Any fraud or fraudulent activity that is related to embezzlement through employment or thefts constitute employee fraud

Financial Fraud: Any fraud or fraudulent activity that is carried out to misrepresent facts with respect to the position of a company in the market, or its financial statements that are publicly available, constitute financial fraud

Bank Fraud: This type of fraud refers to any fraudulent activity wherein customers defraud financial institutions in several different ways

Fiduciary Fraud: When a person is involved in theft or embezzlement in relation to assets that belong to others, resulting in a breach of trust, it is construed as fiduciary fraud

Further Types of Forensic Frauds We Investigate

Flatworld Solutions is a leading forensic accounting service provider and our professionals have extensive experience in conducting fraud investigations. They have delivered investigation services of the following types to many companies across the globe.

Cases of embezzlement and employee thefts

Issues related to lending to customers by financial institutions

Instances of issues related to cash management and billing in medical and dental companies, amongst others

Civil cases of misappropriation or misuse of partner's funds

Probing cases of fiduciary's use or misuse of funds

Areas of dissolution of a marriage - dealing with spouse's use of the property and/or disclosure of funds availables

Calculation of economic damages due to contract breach

Dealing with disputes post-acquisition, like earnouts, warranty breaches, etc.

Cases of reorganization, bankruptcy, or insolvency

Fraud related to securities, tax, laundering of money

Business valuation and revaluation

E-discovery or computer forensics

Corporate or company-specific investigations

Investigations on compliance with anti-corruption measures

Usage of forensic technology

Due diligence

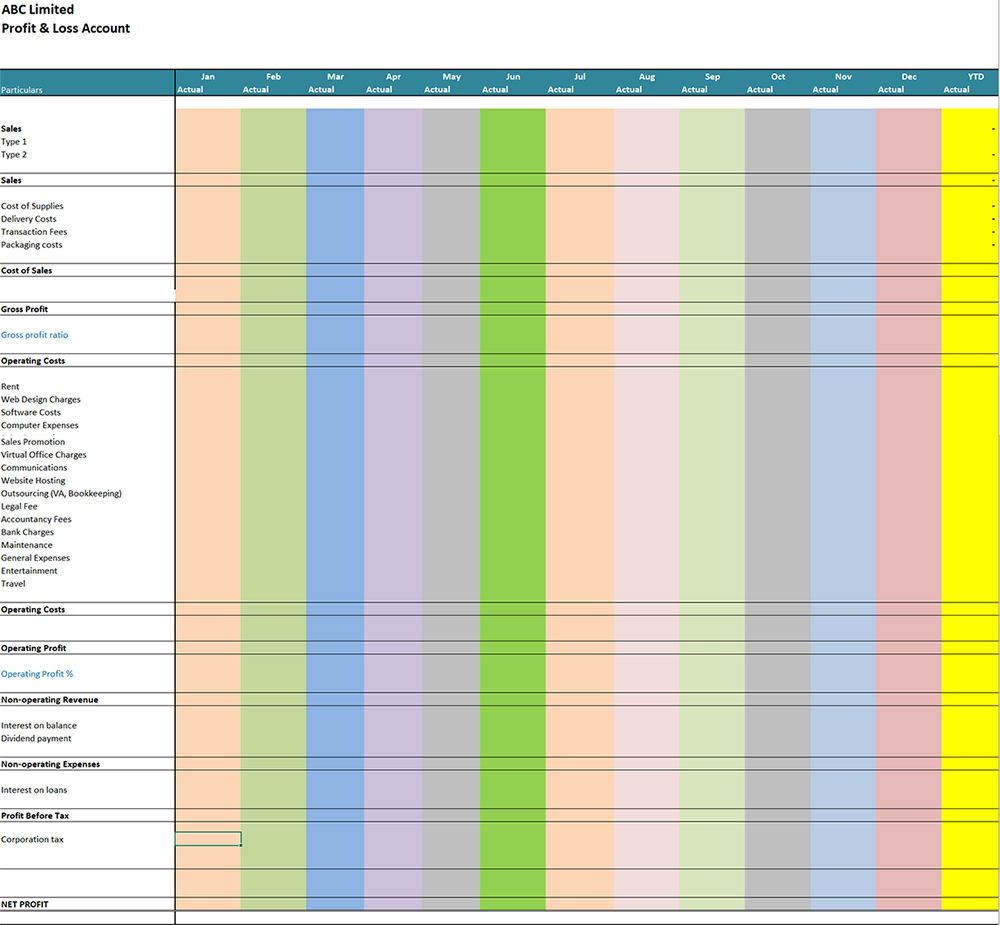

Disputes related to financial reporting

Prevention of fraud and dealing with false claims act

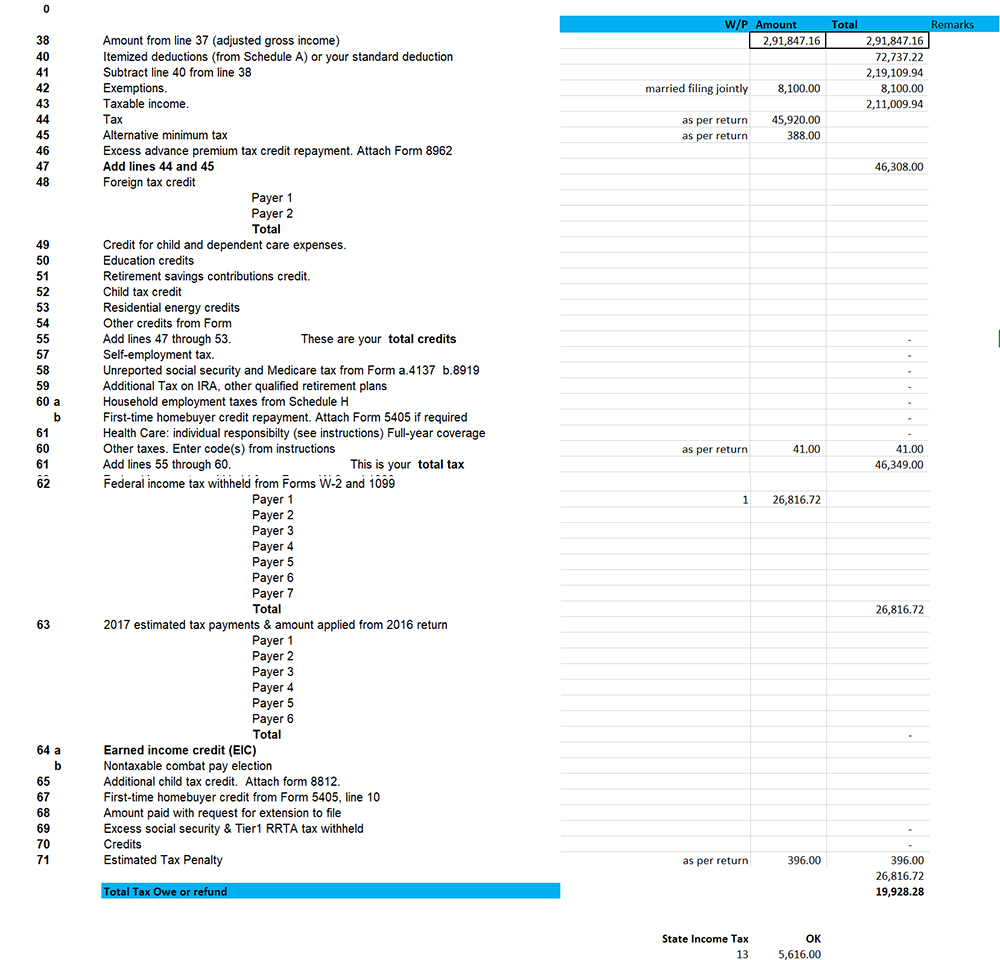

Our Forensic Accounting Process

We believe in providing our clients with highly efficient and quality forensic accounting services and this is made possible by making use of a streamlined and systematic process. The key steps involved in our forensic accounting process are

Requirement Analysis

In the first step, we meet the client and gather the requirements, understand the parties involved, and the facts

Perform Dispute Check

This step is performed to clearly understand the dispute and the reason for conflict between the various parties

Perform a Basic Investigation

This step helps in devising a plan that needs to be carried out by the accountant and creating a master plan keeping the final goal in mind

Accumulating Evidence

This step involves gathering the data pertaining to the dispute between the parties and understanding the conflict in detail

Analyzing the Evidence

This step involves tracing assets, calculating the damage, sensitivity analysis, calculating the value of assets, summarizing transactions, etc

Final Report Creation

The final report is submitted to the client which has ample evidence and data analysis to support the claim in question

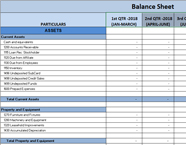

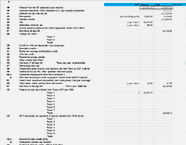

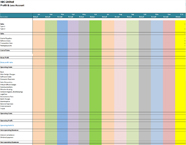

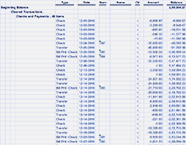

Our Finance and Accounting Portfolio

Accounting

Tax

Bookkeeping

AR

Why Choose FWS for Forensic Accounting Services?

We are a leading forensic accounting service providing company and have been in the financial industry for over 20 years. We understand the exact requirements of our clients with ease and provide them the appropriate services. Some of the reasons for you to choose us are

Affordable Prices

Get flexible pricing options and pay only for what you use. We have access to a high-quality labor pool that charges less for the same quality of service output and we pass on this cost advantage to our clients. Free yourself from hiring and training in-house forensic experts

Latest Software Used

Save costs on buying expensive forensic accounting software. We use the latest and best accounting software to deliver unparalleled services at cost-effective prices.

Date Security

We are committed to protecting your confidential data at all costs and follow international best practices when it comes to handling your data. Get assured data security and confidentiality of all your critical financial data when you work with us. You can also share your files through our secure FTP or we can log in to your system remotely.

Superb Infrastructure

Our forensic accounting experts have access to the best infrastructure in terms of world-class office spaces, uninterrupted network connectivity, and they use the latest tools and technologies.

High Quality

We always deliver high-quality services that you won't find elsewhere at the low prices we offer. Get high-quality financial services compliant with the Sarbanes-Oxley Act from an ISO certified organization that follows accurate forensic audit procedures.

International Standards Followed

We have one of the most experienced forensic teams that follow successful and proven forensic accounting investigation practices. Our team comprises senior and experienced practitioners in fraud investigation, anti-corruption, forensic technology, and other related domains.

Cater to a Large Variety of Organizations

As a leading provider of forensic accountancy services, we have been providing forensic accounting services to almost every type of company, such as financial organizations, law firms, government institutions, insurance companies, equity firms, corporate counsels, venture capitalists, and the top management of companies.

Experienced Team

Our team comprises investigation professionals, data mining and forensic experts, examiners of fraud and fraudulent activities, interviewers of witnesses and testifiers, CPAs, and professionals who are good at collecting and documenting evidence and facts.

Clearly Demarcate Alleged Fraud from Actual Fraud

To clearly demarcate an alleged fraud from an actual fraud you need to remain objective during the investigation. We carefully investigate every scenario and explanation to avoid reaching the wrong conclusion in a case.

Address Many Types of Non-Compliance Issues

Our experts are well-versed in addressing several types of non-compliance issues in the space of accounting and financial services. Not only do we quickly resolve existing issues with our forensic accounting services with minimum business disruption, but we also recommend measures to be taken by you to avoid a similar situation in the future.

We Help You Successfully Respond to Allegations

Whether you are challenged by complexities in accounting or issues related to regulatory compliance and auditing, we can help you address them easily. We help many companies in the US and other geographic locations successfully respond to allegations that they may have received, which are related to regulatory compliance, fraud, fraudulent activities, the impropriety of accounting and financial reporting, and other similar areas.

Quick Turnaround Time

Get quick services from our multiple delivery centers that work round-the-clock to ensure that you receive our services on time every time.

Free Trial

Get access to a free trial of our services and outsource the entire project to us only when you are satisfied with our services.

24/7 Support

Get 24/7 support from our forensic accounting experts via phone or email.

Other Services You Can Benefit From

Outsource Forensic Accounting Services to Flatworld Solutions

We are a leading forensic accounting service providing company and understand the importance of accurate forensic accounting and fraud investigation services. We leverage forensic computing and technological expertise to provide high-quality financial services to our clients. This also includes the capture of electronic data that may be required for investigation and later produced in a court of law. To make sure that frauds do not take place again, our specialists have developed prevention measures for fraud and corruption, which we have implemented for several of our global clients. These measures prevent companies and businesses from having to deal with accounting fraud.

Contact us if you have questions on how to conduct forensic accounting and successful investigation processes to avoid instances of fraud.

Our Customers

Philippines Finance and Accounting Services

Hire experienced and talented Filipino finance & accounting professionals & for your business

USA

Flatworld Solutions

116 Village Blvd, Suite 200, Princeton, NJ 08540

PHILIPPINES

Aeon Towers, J.P. Laurel Avenue, Bajada, Davao 8000

KSS Building, Buhangin Road Cor Olive Street, Davao City 8000

INDIA

Survey No.11, 3rd Floor, Indraprastha, Gubbi Cross, 81,

Hennur Bagalur Main Rd, Kuvempu Layout, Kothanur, Bengaluru, Karnataka 560077