Are you finding it difficult to perform your bank and credit card reconciliation at the end of each month? Is reconciling your bank and credit card statements regularly turning out to be too tedious, time-consuming, and complicated, leaving you exasperated and frustrated? Are you looking for precise and up-to-date bank and credit card reconciliation services that help you keep track of your current financial position? Are you looking to outsource bank and credit card reconciliation services to a reliable and experienced provider? If so, you are in the right place.

Flatworld Solutions (FWS) is an expert bank and credit card reconciliation services provider and has helped numerous companies with their bank and credit card reconciliation needs. We understand that bank and credit card reconciliation is a time-consuming process that is prone to errors and can cost valuable money and time if not done correctly and, therefore, we pay the utmost attention to detail when we undertake these projects. Outsourcing credit card and bank reconciliation services to a professional credit card and bank reconciliation services provider is a wise decision, as you can save on time, effort, cost, and resources.

Our Bank and Credit Card Reconciliation Services

We are a leading bank account and credit card reconciliation services providing company and have both the experience and the expertise to provide an entire range of bank account reconciliation services as well as credit card reconciliation services, including -

Partial reconciliation

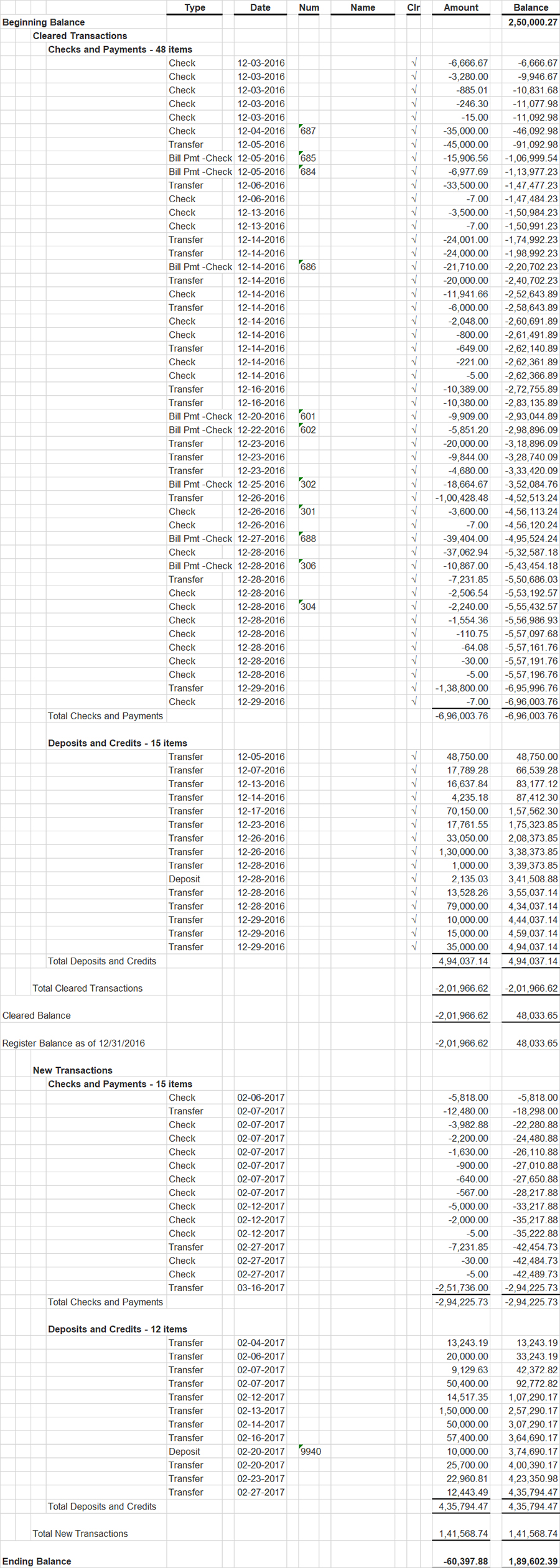

Full reconciliation

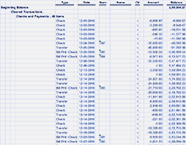

Reconciling your internal financial records with your bank statements

Reconciling your internal records with credit card statements of your customers

Reconciliation of vendor invoices with your general buyer ledger

Reconciling of bank statements with the records maintained by your business

Creation of bank reconciliation reports

Credit card services - Improve your cash flow, recover overdue payments and monitor accounts for late payments

Cheque sequencing services

Reconciling your bank records with your credit card statement

Review of all deposited, cleared, issued, and canceled cheques

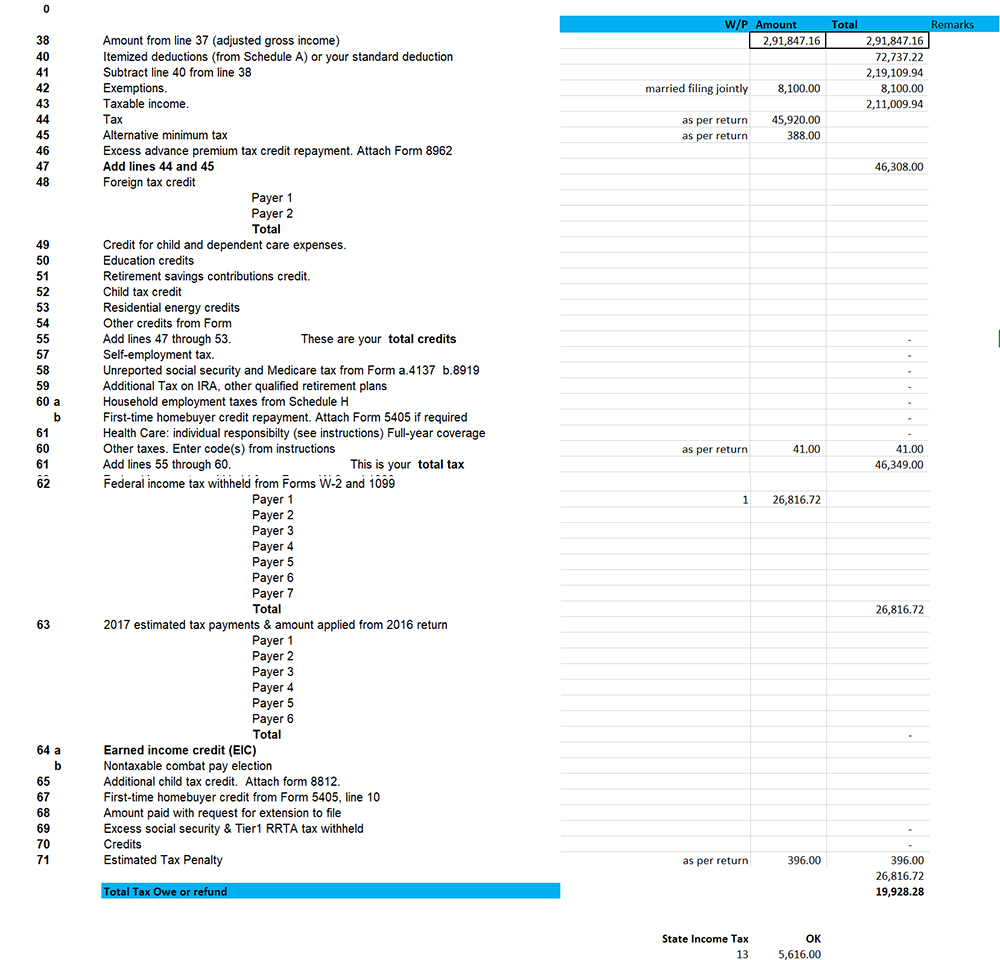

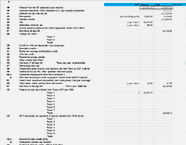

Bank Account Reconciliation Process We Follow

We are a leading bank and credit card reconciliation service company and follow the following bank and corporate credit card reconciliation process for the delivery of our services -

Requirement Gathering

Our team of skilled accountants will interact with your accounts department and understand your bank-account reconciliation needs.

Custom Solution Devised

After understanding the requirements thoroughly, we will devise a customized solution to effectively address your bank management requirements.

Account Reconciliation Performed

You can enjoy complete peace of mind, knowing that our accounting analysts are balancing your cash balances after making sure that all your information is 100% accurate.

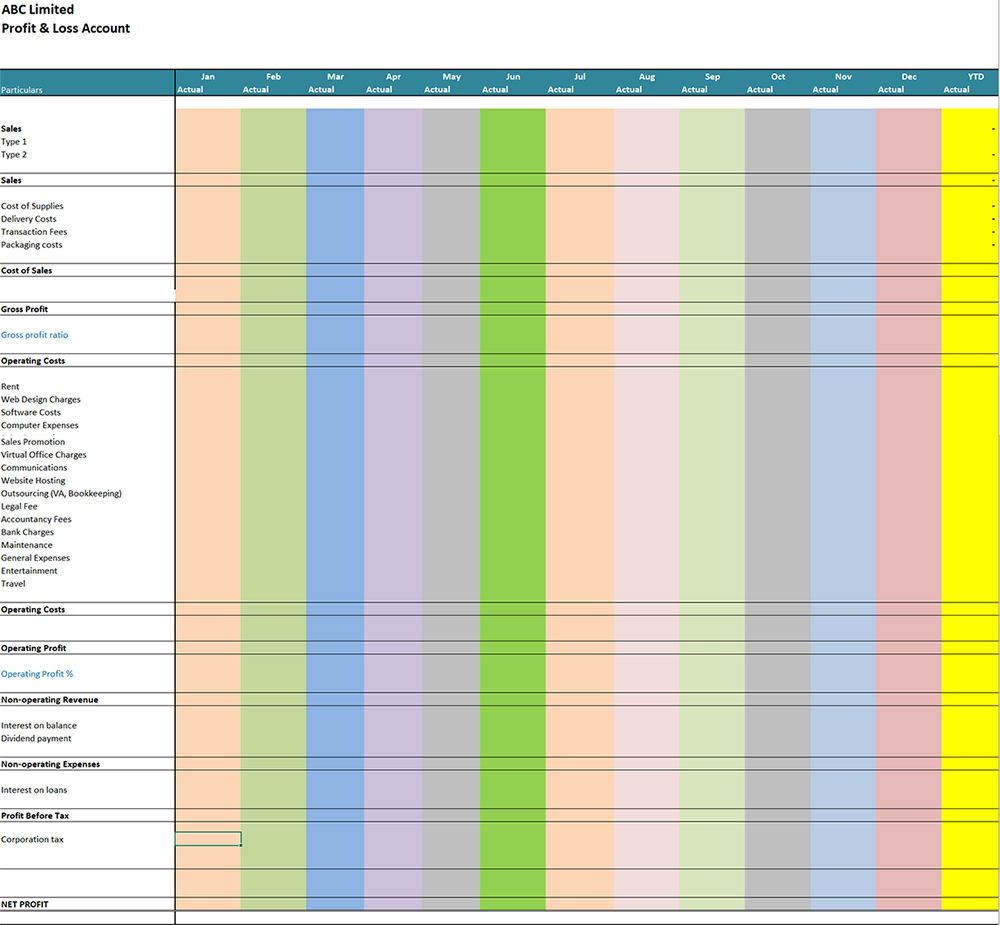

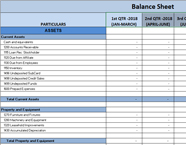

Our Finance and Accounting Portfolio

Accounting

Tax

Bookkeeping

AR

Why Outsource Bank and Credit Card Reconciliation Services to Us?

Affordable Pricing

We provide customized services that are high on value and low on cost for specific projects as well as ongoing tasks.

100% Data Security

We provide complete assurance of data security with binding non-disclosure agreements and secure web servers.

Financial Software

We can use any accounting software be it QuickBooks®, Pro Tax®, Quicken®, Peachtree®, IRIS®, Lacerte®, MYOB® or Sage Line 50®.

ISO Certified Processes

ISO certified processes are used to deliver bank and credit reconciliations and are 99% accurate.

Full Compliance

We provide bank reconciliation services that are compliant with the Sarbanes-Oxley Act and other statutory/ regulatory requirements.

Experienced Team

Get a team of qualified and certified accountants with the domain expertise to work for you at an affordable cost.

Get Deeper Insights

Gain deeper insight into the current state of your finances - pay invoices, purchase equipment, and address investors with complete confidence.

Identify Discrepancies

Easily identify a track, and resolve discrepancies within your business. Also, detect and reconcile discrepancies in your internal financial transactions and records.

Control Cash Flow

With our services, you can reduce cash in suspense accounts and control your cash flow.

Recognize Timing Differences

Recognize the timing differences between your business' records and the bank's records.

Analyze and Assess

Use expert financial reports to analyze and assess your company's financial performance.

Get a Better Financial Perspective

Get a better perspective of where your company stands and make informed decisions about your organization's future.

Exercise Appropriate Credit Control

Exercise proper credit control by getting the details of all your outstanding checks and deposits, if any.

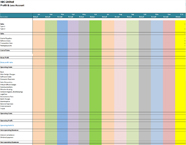

Accounting Software We Use

We are a professional bank and credit card reconciliation services providing company are proficient in using all the latest and best accounting software, including -

Outsource Bank and Credit Card Reconciliation Services to Flatworld Solutions

With Flatworld Solutions handling your bank and credit card reconciliations, you can make well-informed business decisions and save on costs while ensuring that your finances are accurately tracked and handled. We let you focus on your business while we take complete responsibility and the tiresome burden of managing your bank and credit card reconciliations.

Try our services today and get your finances progressively reconciled.

Our Customers

Philippines Finance and Accounting Services

Hire experienced and talented Filipino finance & accounting professionals & for your business

USA

Flatworld Solutions

116 Village Blvd, Suite 200, Princeton, NJ 08540

PHILIPPINES

Aeon Towers, J.P. Laurel Avenue, Bajada, Davao 8000

KSS Building, Buhangin Road Cor Olive Street, Davao City 8000

INDIA

Survey No.11, 3rd Floor, Indraprastha, Gubbi Cross, 81,

Hennur Bagalur Main Rd, Kuvempu Layout, Kothanur, Bengaluru, Karnataka 560077